Auction catalogues, online listings, and live sales use a specific vocabulary. A new bidder may recognise the coin but misread the terms around it. One word can change the final cost, risk level, or buyer protection.

Many collectors rely on a free coin identifier to organise their sets, yet auctions demand a different skill set. Prices move fast, conditions vary, and descriptions compress complex information into short phrases. Understanding these terms prevents costly mistakes and gives you control before placing a single bid.

Here we offer to discuss the core auction language, how fees work, which signals indicate risk, and how to read the structure behind every coin listing.

Buyer’s Premium, Hammer Price, and Total Cost

Auction houses use three numbers. Confusion around them creates overspending.

Hammer price → The amount reached when the auctioneer says “sold.” This is not the amount you pay.

Buyer’s premium → A fixed percentage added to the hammer price. Most houses charge 10–25%. Some add sliding rates.

Total cost → Hammer price + premium + taxes + shipping + payment fees.

A simple table makes the difference clear:

| Hammer | Premium (20%) | Subtotal | Shipping | Final Cost |

| $200 | $40 | $240 | $12 | $252 |

| $450 | $90 | $540 | $18 | $558 |

| $1,000 | $200 | $1,200 | $25 | $1,225 |

Even small premiums change your limit. Always calculate backwards. Define your maximum final cost and subtract all fees to find the true bidding ceiling.

Reserve, Opening Bid, and Bid Increments

Auction language around starting positions often misleads beginners. These three terms clarify the process.

Reserve

A hidden minimum the seller requires. If bids do not reach it, the lot does not sell. A coin may show active bidding yet stay unsold because no one hit the reserve.

Opening bid

The first amount the system accepts. It may or may not reflect the reserve. Some houses set a low opening to attract interest.

Bid increments

Mandatory steps between bids. Each level has a fixed jump. For example:

- $1–$99 → +$5

- $100–$499 → +$10

- $500–$999 → +$25

- $1,000+ → +$50 or more

You cannot bid “a little more.” The system enforces increments. Understanding them helps you time bids and avoid raising your own maximum too early.

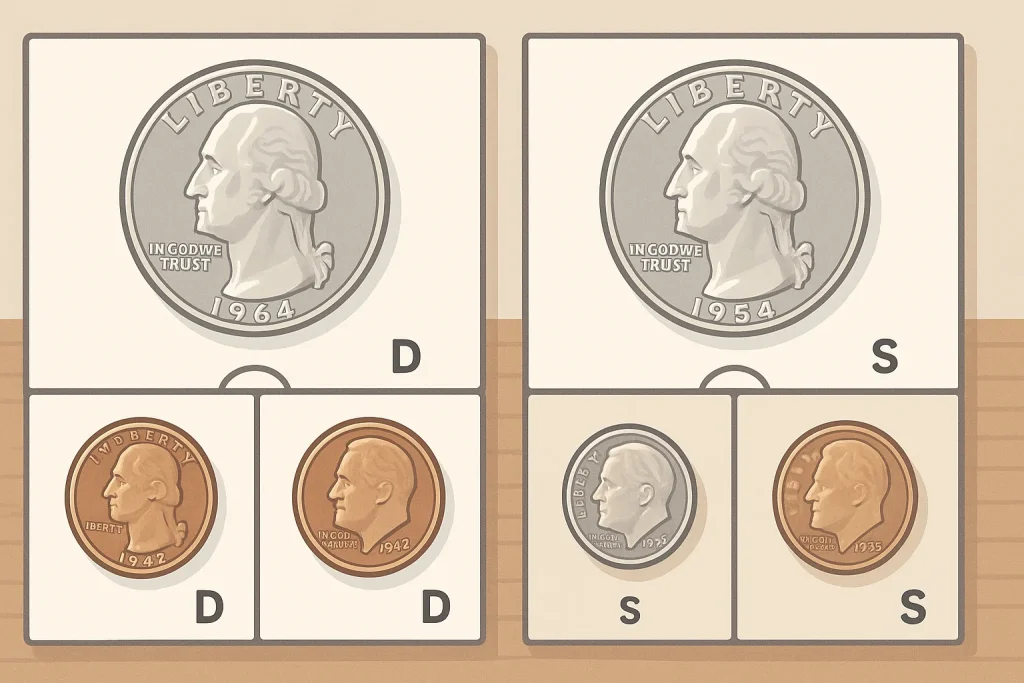

“Raw,” “Certified,” and “Slabbed” — What These Labels Mean

Auction descriptions often include grading shorthand. Each label reflects a different level of risk.

Raw Coins

A coin is sold without certification. The grade is only the seller’s opinion. The risk of cleaning, damage, or alteration is higher. Raw coins may look attractive, but they hide defects not shown in photos.

Certified

A coin graded by PCGS, NGC, or ANACS. The label gives a grade and sometimes strike designations. Certification reduces risk but does not remove it completely; eye appeal varies even within the same grade.

Slabbed

A certified coin sealed in a hard plastic holder. The slab protects against scratches and confirms that the certification is genuine.

A coin identifier app helps you confirm type, metal, and minting years, but it does not validate grade or detect cleaning. Always compare visual details with certified examples before bidding.

How to Read Auction Lot Descriptions Without Missing Red Flags

Auction descriptions look simple, but each line carries meaning. A short note may hint at risk, reduced value, or hidden problems. Many beginners focus only on the grade and the photo. Experienced collectors read the entire entry because the language shows what the seller wants you to notice and, more importantly, what they avoid stating.

A typical lot description includes:

- Title: series, year, mintmark, denomination.

- Grade: certified or raw, numeric or descriptive.

- Notes: strike strength, surface remarks, and disclaimers.

These components give enough information to evaluate the coin when combined with close inspection.

Words that Require Attention

Certain terms always deserve a second look. They often appear when the seller expects objections.

- “Details” → the coin has a problem that affects its value.

- “As is” → no returns; you accept all risks.

- “Cleaned” → surface altered; price should drop sharply.

- “Weak strike” → natural softness, but still reduces eye appeal.

- “No guarantee of grade” → seller distances themselves from the stated grade.

Descriptions rarely explain severity. “Cleaned” can mean minor hairlines or harsh scrubbing. “Weak strike” can mean a typical strike for the series or a significant loss of detail. You need the photos to confirm which case applies.

How to Check a Listing

Use a structured approach before bidding:

- Confirm the grade or grade range.

- Inspect the note section for problem language.

- Compare with certified examples to understand what a correct detail should look like.

- Study the mintmark shape, placement, and spacing.

- Ensure the listing shows complete images of rims, digits, and key relief areas.

A good description answers questions directly. A vague one shifts responsibility to the buyer. Treat unclear entries as higher risk.

Common Grading Terms and Auction Shorthand

Auction houses compress grading language into minimal text. Knowing these terms gives clarity.

MS (Mint State): Uncirculated. Numerical scale from MS60 to MS70. Higher numbers show fewer marks and stronger luster.

AU (About Uncirculated): Light wear on the highest points. Still sharp in detail.

XF or EF (Extremely Fine): Moderate wear. Many details are visible.

VF (Very Fine): Clear wear on high areas. Major details intact.

F (Fine): Considerable wear. Outlines remain clear.

Other auction terms:

- “Prooflike” — mirror-style fields

- “DMPL” — deep mirror prooflike

- “Choice” — above average for the grade

- “Net grade” — penalty applied for problems

- “Details grade” — grade adjusted due to damage or cleaning

These labels guide expectations. They help you judge how the coin will look upon arrival.

Pre-Bid Research: How to Verify Value and Condition Before You Bid

An informed bidder makes fewer mistakes. Research protects you from chasing inflated prices and reduces emotional bidding. You can start with simple steps:

- Study recent auction results.

Prices shift depending on grade, eye appeal, and market activity. Check several examples, not just one. This shows realistic expectations and avoids overpaying.

- Check series-specific strike habits.

Each series has typical strike patterns. Some coins strike weakly in certain areas, even in high grades. Knowing these patterns prevents confusing weak strike with wear.

- Examine seller policies.

A strong seller offers clear returns and detailed photos. A low-quality seller avoids specifics, uses vague language, or refuses extra pictures.

- Define your true maximum.

Calculate the final cost first. Then work backwards to determine the highest hammer price you can afford after premiums and shipping.

- Confirm alignment between listing and reference data.

Metal type, diameter, weight range, and design elements must match known specifications. Any mismatch deserves attention.

Clear preparation keeps you from rushing decisions during live bidding. Research stabilises your choices and gives confidence at each stage.

Understanding Auction Formats: Live, Timed, Proxy, Soft Close

Auction formats shape how bids move, how collectors react, and how final prices form. Many beginners focus only on the coin and ignore the structure of the auction itself. This leads to rushed decisions, missed signals, and overbidding. A clear understanding of each format gives you control. You know when to wait, when to act, and when to stop. Once you understand the mechanics, bidding feels predictable instead of chaotic.

Each format below follows its own rhythm. Some reward quick reactions, while others give time to plan. If you match your strategy to the format, you avoid the most common auction mistakes.

Auction Format Comparison

| Format | How It Works | Key Traits | Best For |

| Live auction | Auctioneer sets the pace; bids move in real time | Fast decisions, rising pressure, minimal hesitation | Collectors with experience and strong price awareness |

| Timed auction | Bidding ends at a fixed moment | Predictable schedule, heavy action near closing | New bidders who benefit from structured timing |

| Proxy bidding | You set a maximum; the system bids automatically | Stable spending control, reduced emotional errors | Buyers who cannot monitor every change |

| Soft-close auction | Deadline extends after last-second bids | Prevents sniping, keeps competition fair | Bidders who want time to react without rushing |

Why This Matters for Real Bidding

Understanding these structures helps you avoid traps common at auctions. Live events reward fast judgment and punish hesitation. Timed auctions create pressure in the final seconds, so knowing the closing pattern keeps you from submitting late bids that never register. Proxy bidding protects your budget when multiple lots run at the same time. Soft-close auctions eliminate sniping, so you focus on real value instead of speed.

What Apps Can and Cannot Do When Preparing for Auctions

Apps help you collect information, but they do not replace physical evaluation. Many bidders use digital tools to sort coins, catalogue purchases, or confirm basic attributes. That is where apps perform well. They clarify type and metal composition, and they show how a genuine coin should look. But they cannot validate authenticity or confirm surface quality.

A coin app for Android or iOS reads visible patterns and matches them with photos. It cannot identify cleaning, counterfeiting, or altered digits. It also cannot evaluate luster or strike strength. Still, the right app becomes a strong support tool when used correctly.

What apps help with:

- Confirming the correct series

- Checking the official metal composition

- Reviewing minting years

- Verifying design elements shown in the listing

- Comparing the coin with known examples

What apps cannot detect:

- Counterfeit dies

- Altered mintmarks

- Tool marks

- Polishing or harsh cleaning

- Hidden rim damage

Coin ID Scanner gives weight, diameter, metal, country, and date range. If these values differ from what you see in the listing, you know the coin deserves closer inspection. The app works as a filter, not an evaluator. Pair it with direct comparison against certified images and your own observation.

Learn the Language, Control the Process

Auction success depends on a clear understanding, not luck. Once you know how to read terms, interpret photos, evaluate grades, and calculate fees, you control the process. Structured habits, steady research, careful review, accurate measurements, and comparison with certified examples are the things that keep your bids within safe limits. And once you know the main things, each purchased coin builds a stronger intuition for the next one.